NewMarket: A Strong 2023 But Not Enough Details On A Recent Acquisition

Summary

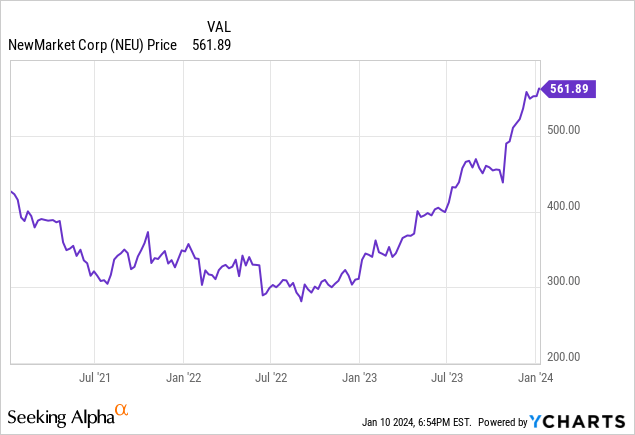

- NewMarket's share price has increased by approximately 50% since January 2021, outperforming the S&P 500.

- The company's strong financial results and expanding margins have contributed to its share price performance.

- Details of NewMarket's acquisition of AMPAC are not yet fully disclosed, making it difficult to assess its impact on the company's financials.

3DSculptor/iStock via Getty Images

Introduction

It has been three years since I last discussed NewMarket (NYSE:NEU), and it is definitely time for an update. The company's share price has been all over the place, but the total return since that January 2021 article is approximately 50%, compared to just under 28% for the S&P 500 (SPY) index. A decent result, but definitely not overwhelming.

As mentioned in the previous article, NewMarket is a holding company owning Afton Chemical, which produces petroleum additives (including fuel additives and lubricants) while another subsidiary, Ethyl Corp., produces antiknock compounds primarily used in the automotive industry. NewMarket mentions in its most recent annual report it is one of the four largest manufacturers and suppliers in the petroleum additives marketplace.

A strong set of results, but the stock is getting pricey

One of the elements I appreciated most in NewMarket was its commitment to provide a 10% compounded return per year. While the company warned it wouldn't post 10% growth results every year, the 10% compounded returns are its main target for every five-year period. The company expects the petroleum additives market to grow by 1-2% per year, and it plans to grow its own business at a faster pace by gaining market share.

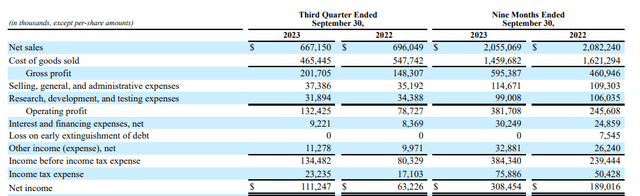

And although the current times aren't easy for NewMarket either, despite keeping its revenue stagnant (with a 4% decrease in the third quarter), its margins are expanding. As you can see below, it reported a 36% increase in its gross profit. And as most other operating expenses remained unchanged, its operating profit increased by almost 70%.

This obviously resulted in a very strong net profit of $111.2M during the third quarter, which equals an EPS of $11.60. While the third quarter was very strong, the entire financial year 2023 is shaping up to be pretty good. Although the 9M 2023 revenue decreased by just over 1%, the gross profit increased by approximately 30% resulting in an operating profit increase in excess of 50%. The net income in the first nine months of this year exceeded $308M for an EPS of $32.05. And that definitely helps to explain the strong share price performance in the past few months.

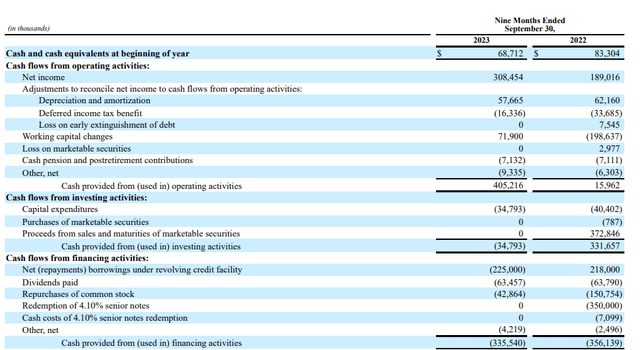

Generating $308M in net profit is great, but as I was focusing on the company's free cash flow performance in the previous article, I also wanted to check if the company was effectively able to convert the net income into free cash flow.

The cash flow statement below shows the company reported a total operating cash flow of $405M, including a $7.1M cash payment to cover the pension deficit on the balance sheet. You also clearly see there was a $72M contribution from working capital changes, which means the adjusted operating cash flow was approximately $333M (I am still including the pension payments).

The total capex in the first nine months of the year was just under $35M, resulting in a net free cash flow result of $298M or approximately $31/share based on the current share count of 9.6 million shares.

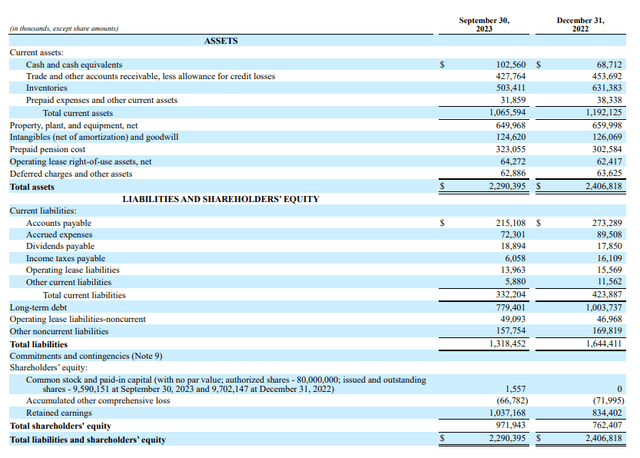

The strong cash flows obviously helped to reduce the net debt. As the balance sheet below shows, NewMarket had approximately $102M in cash on the balance sheet while it had no current debt and just $779M in long-term debt, resulting in a net debt position of approximately $677M. That's a nice improvement compared to the $935M in net debt at the end of FY 2022.

The 9M 2023 EBITDA came in at just over $471M, which means the leverage ratio was a very respectable 1.1, down from 2.0 at the end of FY 2022.

This leverage ratio will increase in the current quarter as NewMarket has signed an agreement to acquire AMPAC Intermediate Holdings for $700M. AMPAC is the leading manufacturer in North America for 'critical performance additives used in solid rocket motors for space launch and military defense applications'.

Unfortunately, the company has not disclosed any details on this transaction so we simply don't know how much EBITDA or free cash flow AMPAC was generating, and this makes it difficult to assess this acquisition. NewMarket's management has a decent M&A track record. Based on Fitch's expectations to see EBITDA leverage peak at 2.6 in 2024 following the acquisition, it doesn't sound like AMPAC will be a major EBITDA contributor.

Investment thesis

While I am impressed with NewMarket's performance in 2023, it is a pity the company did not disclose more details on its $700M AMPAC acquisition. I understand the need and preference to diversify, but I hope the company will provide more color on this transaction when it releases its annual report.

As such, I'm not chasing the stock here until I see more details. Excluding the AMPAC acquisition, the stock is currently trading at about 10 times EBITDA, which means a 'hold' rating appears appropriate for NewMarket right now. I'll be happy to have another look if/when the company discloses more details on the acquisition.