Coherus Biosciences: Dumping One Drug But Showing Promise With Another

Summary

- CHRS has sold Cimerli, a Lucentis biosimilar, to SDZNY.

- CHRS anti-IL-27 antibody, casdozokitug, shows promising results as part of a triple therapy in hepatocellular carcinoma, with an overall response rate of 38%.

- Numbers on market share point to a strong Q1'24 for Udenyca, which could increase the market's confidence that CHRS can offset lost revenues from the Cimerli sale.

- CHRS has data in H1'24 from a phase 1 trial of its anti-CCR8 antibody, CHS-114, in solid tumors, adding a catalyst to the calendar.

MCCAIG/iStock via Getty Images

Coherus Biosciences (NASDAQ:CHRS) has a pipeline of marketed drugs, including a new drug and biosimilars, but also a developmental pipeline. When I wrote about CHRS in January, I rated it a hold, noting a near-term catalyst of updated clinical data from casdozokitug in liver cancer, the launch of a new biosimilar product and the launch of its new drug. This article takes a look at the new clinical data and developments since, which have led me to upgrade my rating from hold to buy.

CHRS sells Cimerli

Since my last article we still don't have a full quarter of sales data on the recent launch of Loqtorzi (toripalimab, CHRS anti-PD-1 antibody) in nasopharyngeal carcinoma (NPC). However there has been a key update to CHRS' pipeline of marketed drugs, with the sale of Cimerli (a Lucentis biosimilar containing ranibizumab-eqrn) to Sandoz (OTCQX:SDZNY; OTCQX:SDZXF) for $170M upfront, which closed on March 4, 2024.

Figure 1: CHRS pipeline of marketed drugs. (CHRS website.)

Cimerli was for eye disease and arguably didn't fit in as well with CHRS other drugs in the rheumatology/immunology and oncology business containing Loqtorzi, Yusimry (a Humira biosimilar containing adalimumab-aqvh) and Udenyca (a Neulasta biosimilar containing pegfilgrastim-cbqv).

Casdozokitug performs

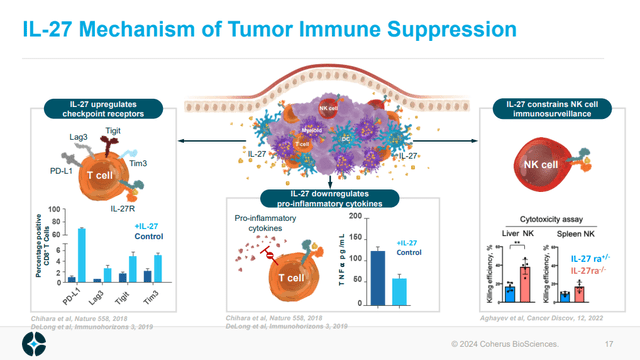

On the developmental pipeline side of things, CHRS has reported updated data from casdozokitug. Casdozokitug is an antibody against interleukin-27 (IL-27). IL-27 plays an anti-inflammatory role, potentially aiding the suppression of the immune system's fight against cancer. For example, IL-27 increases the expression of immune checkpoint receptors on T-cells, downregulates pro-inflammatory cytokines and reduces the ability of natural killer cells to kill.

Figure 2: Overview of IL-27 mechanisms of suppressing the immune system response to cancer. (CHRS Corporate Presentation, January 2024.)

In my last article I noted casdozokitug had shown activity as monotherapy in non-small cell lung cancer, albeit at a middling rate with just two confirmed partial responses (PR) seen in 38 NSCLC patients. CHRS does note these two PR's were in patients with the squamous form of NSCLC and so in that subset of patients, the response rate was 2/9 (22%). It is of course possible that subgroup analysis leads nowhere promising in future trials, perhaps it is a coincidence. Nonetheless, it does provide evidence of casdozokitug working as a monotherapy.

A more impressive performance came with casdozokitug in hepatocellular carcinoma (HCC) where its use in combination with bevacizumab and atezolizumab produced a response rate of 27%, as of an April 2023 data cutoff (slide 19). By comparison, new data presented at ASCO-GI in January note an improved overall response rate of 38%, 11 PR's (one unconfirmed PR at the time of cutoff) and three complete responses (CR) from 29 patients. CHRS noted it planned to evaluate a combination of casdozokitug with toripalimab (instead of atezolizumab) and bevacizumab in future trials.

Financial Overview

CHRS reported net revenue of $91.5M in Q4'23, although net sales of $52.4M in the quarter from Cimerli can't be relied upon going forward. Selling Cimerli for $170M upfront, plus $17.8M for inventory and prepaid manufacturing assets, will allow CHRS to clean up its balance sheet, with the company noting it plans to prepay $175M of its $250M principal outstanding as part of its term loan with Pharmakon Advisors LP. That's a welcome development, in my opinion, as I previously noted that CHRS debt vs cash was not good for the optics of any bull thesis.

The company operating with just over $130M cash isn't the best look with $246.2M in debt from its term loans on the balance sheet.

Biotech Beast comments on CHRS, January 17, 2024.

SG&A expense was $49.5M in Q4'23 and R&D expense was $26.4M in the same quarter. Net loss for Q4'23 was $79.7M, and net cash used in operating activities was $174.9M in 2023. At year-end 2023, CHRS had cash, cash equivalents and investments in marketable securities of $117.7M. At the 2023 rate of cash burn, CHRS would be out of cash in about 8 months, without even considering the Pharmakon term loans. A lot is changing though, while the Cimerli sale will bring in $187.8M total, prepaying $175M of the loan will leave a balance of $75M. The prepayment would also require a prepayment premium and makewhole amount of $6.8M, so in total would use up $181.8M worth of the funds brought in from the Cimerli sale, leaving just $6M.

... the Company plans to repay $175.0 million and the prepayment premium and makewhole amount of $6.8 million to the Lenders on or before April 1, 2024 pursuant to the Consent and Amendment.

Comments from CHRS recent 10-K.

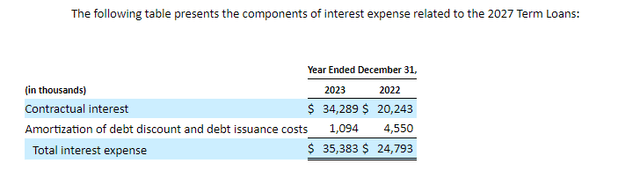

As such CHRS' year-end cash of $117.7M plus $6M, $123.7M, is a good starting number to use for cash burn calculations, but the net cashed used in 2023 number probably isn't too reliable. Firstly, with Q4'23 earnings, CHRS announced it had initiated a work force reduction of 30%, as of March 7, which it plans to complete by the end of 2024. Further paying down the loan is expected to reduce interest payments to Pharmakon Advisors LP by about 70%. Notably, CHRS' interest expense was $40.5M in 2023, and interest expense specifically due to the 2027 term loans with Pharmakon Advisors LP, was $35.4M.

Figure 3: Screenshot from CHRS 10-K. Note this interest expense applies specifically to the Pharmakon loan, total 2023 interest expense was $40.5M. (CHRS 10-K.)

As such, we could expect savings from reduced interest expense of about $25M alone in 2023. Further due to the workforce reduction, CHRS expects annualized cost savings over $25M. CHRS has guided to SG&A and R&D expenses of $250M-$265M in 2024, which it notes is at least 12% decrease from $301.5M in 2023.

There were 112,714,488 shares of CHRS common stock outstanding as of February 29, 2024, CHRS has a market cap of $250.2M ($2.22 per share).

Can Udenyca Onbody and Loqtorzi deliver

The ability then, for CHRS to maintain a good buffer between its cash and debt is certainly in play, with estimated cash ($123.7M) minus debt (~$75M) at $48.7M, but there is a lot riding on the launch of Udenyca Onbody and Loqtorzi.

It would be ideal for CHRS to replace the lost revenues from Cimerli, net sales of which were $125.4M in 2023, which accounted for about half of CHRS net revenue of $257.2M in 2023, while reducing SG&A & R&D expenses, and certainly reducing interest expense. If CHRS can do that, then the idea that the buffer between its cash and debt might be sufficient isn't unfounded. Notably, Udenyca brought in net sales of $127.1M in 2023, grew 10% from Q3'23 to Q4'23 and is now launching in a new form, Udenyca Onbody.

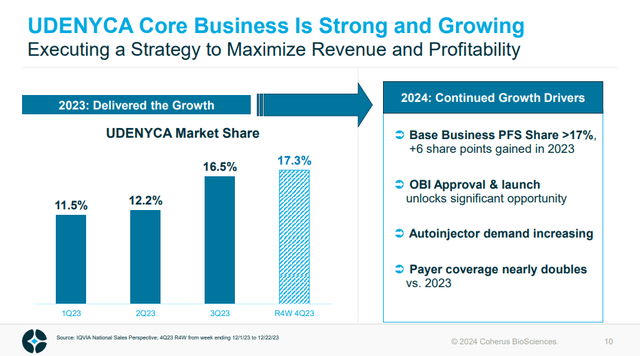

Figure 4: Udenyca market share by quarter. (CHRS Corporate Presentation, January 2024.)

Indeed the $127.1M in sales come despite the autoinjector form only launching in 2023. The Onbody injector has just launched and is perhaps resistant to competition due to the device used, so might help CHRS grow the Udenyca franchise substantially. In the figure above, CHRS noted market share of 17.3% from a period in December, but as of Q4'23 earnings that number was 26%.

Based on data from IQVIA, rolling 4-week UDENYCA market share as of March 1 was 26%.

CHRS comments, Q4'23 earnings press release, Mar 13, 2024.

If a 17.3% market share yielded Q4'23 net sales of Udenyca of $36.2M, it is possible that a 50% growth in market share to 26% could yield revenues of $54.4M, and that's with the Onbody form only launching in February. If CHRS saw no further growth, that would bring in $217.6M in 2024 alone. The idea then that Udenyca net sales could double in 2024, rather than just increase 50% as reflected by the market share numbers, is also possible but that is a bit more optimistic.

On Loqtorzi I believe it will take some time for revenues to grow since the estimated number of treated NPC patients in the US is about 2000 patients a year. but the drug being added to the National Comprehensive Cancer Network (NCCN) guidelines for NPC should help its launch.

With Yusimry, it brought in only $2.2M in Q4'23 and launched in July 2023. It might continue to grow but I don't have much hope for it.

Conclusions, rating and risks

CHRS has an exciting potential drug with casdozokitug. Continuing to spend money on developmental stage R&D when there is only about a $50M buffer between its cash and principal outstanding on the Pharmakon term loans might be questioned by some. Still I expect strong sales in Q1'24 from Udenyca given the company's comments on market share, and perhaps the company can give further preliminary numbers with Q1'24 earnings on market share. Such numbers should boost confidence that CHRS can do without Cimerli, and that Udenyca will continue to grow. Any revenue growth from Yusimry and Loqtorzi on top of that will represent a bonus. CHRS also has data from a pipeline member which I mentioned in my previous article, CHS-114, due from a trial in solid tumors in H1'24. That is only a phase 1 study, but there could still be demonstration of anticancer activity, and CHRS' earnings call notes the compound is nearing completion of dose escalation.

I rate CHRS a buy because I think the preliminary signs point to the company being able to deal with the loss of revenues from Cimerli, both in terms of Udenyca providing revenue growth, but also in terms of reduced interest expense, and reduced R&D and SG&A expense thanks to the restructuring. Further, data from CHS-114 provides a catalyst in H1'24 and I think the new data with casdozokitug indicate the company may have something of value with that pipeline member.

The risks of any long in CHRS are several fold, a few of which I'll consider here. Firstly, if CHRS doesn't perform with Q1'24 earnings, then the share price is likely to take a hit on concerns the company may have to restructure further, sell assets or perhaps dilute investors.

Secondly, if CHRS reports Q1'24 sales numbers that impress the market but market share percentages for Udenyca that don't show a further increase, then concerns will exist about the sustainability of any increase in sales.

Lastly, if CHRS engages in further business development to clean up the balance sheet, but it isn't well received by the market, then the stock could fall. I'd like to see the company consider offloading Yusimry, but if the terms of any sale aren't particularly impressive, the stock could fall.