Boot Barn: Strong Cash Position, Long-Term Growth Prospects, Short-Term Headwinds

Summary

- Boot Barn has experienced strong growth in revenue and plans to add 500 additional stores in the next six years.

- The company's e-commerce sales and same-store sales have declined, but new store sales have softened the blow.

- Despite short-term challenges, BOOT has a strong cash position and a long-term growth strategy, making it an attractive investment option.

GaryAlvis

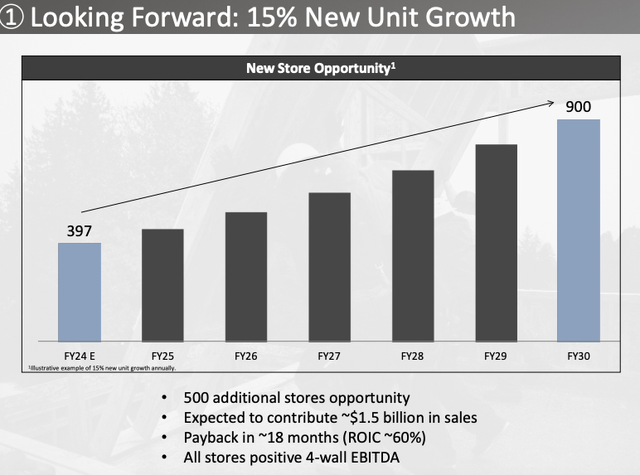

One year ago, I recommended a bullish stance on Boot Barn, Inc. (NYSE:BOOT) for a number of reasons. Firstly, the company is well positioned in a TAM of $40 billion industry by mainstreaming its portfolio, which includes a large number of higher margined exclusive brands, while still benefitting from its focus on Western and workwear, which has less competition and stickier customers than your typical retailer and therefore less prone to discounting actions. Secondly, it has doubled its revenue in three years by growth in the format of new and higher revenue-generating store models throughout the US. The company has a strong cash position and plans to add 500 additional stores in the next six years, expecting this to contribute an extra $1.5 billion to the top line. Lastly, the stock was and continues to trade well below its peak of $130. Since my first article, investors have been rewarded with returns of 13.65%.

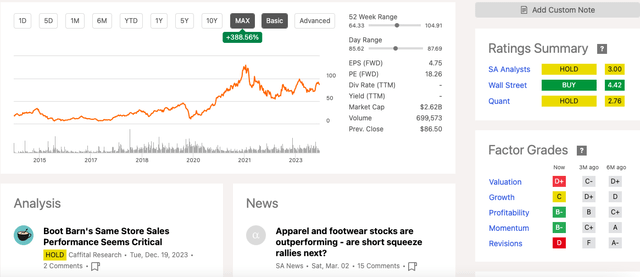

Historic stock trend (Seeking Alpha)

One of my concerns is whether these stores can maintain a healthy growth rate. Although the company has beaten EPS results over the last four quarters, it missed revenue expectations in three of the four quarters, which indicates that sales are less than we would expect. Boot Barn's e-commerce sales have disappointed and put a dent into the performance, with a double-digit decline. Furthermore, same-store sales have also declined. It's only additional new store sales that have softened the blow. On top of that, the upcoming Q4 2024 is one week shorter this fiscal year. This has led to a reduced FY2024 guidance. I remain confident of the company's long-term performance, however, due to short interest increasing to 13.64% and an exaggerated stock price reaction to the not-so-impressive Q3 2024 results, alongside two significant insiders selling off shares in February. I believe this has increased the stock's potential for volatile activity, therefore recommending a hold rating for long-term investors.

Company updates

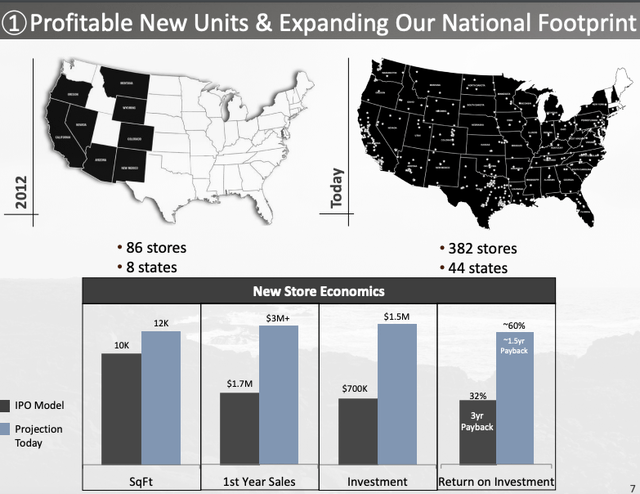

In my previous article, I give an overview of the company. Boot Barn has been swiftly increasing its presence and brand recognition over the last twelve years by increasing its number of stores throughout the US to 382 across 44 states. Furthermore, the company has expanded its Western and workwear portfolio and added a country lifestyle segment, which gives it a TAM of $40 billion, reaching customers through an omnichannel selling strategy. The company's e-commerce strategy is to use four owned websites, apps, and third-party marketplaces.

2012 to now new store growth (Investor presentation 2024)

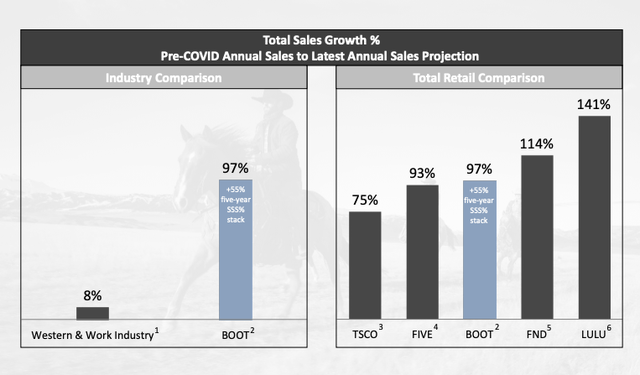

Its strategies since pre-COVID have been hugely successful compared to its direct industry, and it has performed well across a total retail comparison, as seen in the charts below.

Sales growth versus peers (Investor Presentation 2024)

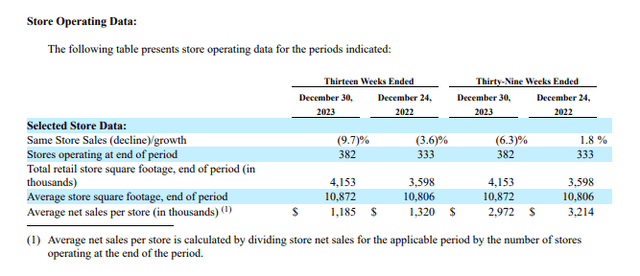

However, the company is struggling with its e-commerce sales, which have decreased in the double digits by 11.5%, and the same-store sales have declined by 9.7% YoY in Q3 2024. This has led to a lowered FY 2024 guidance.

Same Store Sales Q3 2024 versus Q3 2023 (Sec.gov)

While the temporary decline in sales is something to be cautious of, the company has increased stores opened by 15% YoY, and these new store sales have allowed for net revenue to increase. Thus far, the stores have proven successful and profitable within 18 months. The company aims to expand the number of stores further, increase same-store sales growth, strengthen its brand portfolio and focus on its omnichannel strategy through capex into technology, distribution centres, and stores, for which it has the cash position and strong cash flow from operations to do so. Capex for FY 2024 will be between $95 million and $105 million. This indicates that we should see significant growth in the coming years.

Store growth (Investor presentation 2024)

Financial update

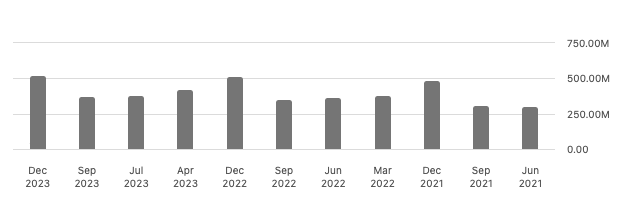

Boot Barn is a much larger company than three years ago due to its aggressive growth strategy. The company has been increasing its top-line results to $1.7 billion TTM, and its three-year revenue growth CAGR has been a 27.45% increase. However, TTM revenue is slowing down significantly, impacted by weaker-than-expected e-commerce sales. This is even more telling if we consider that Q3 is typically the company's strongest revenue generator.

Revenue by quarter (Seeking Alpha)

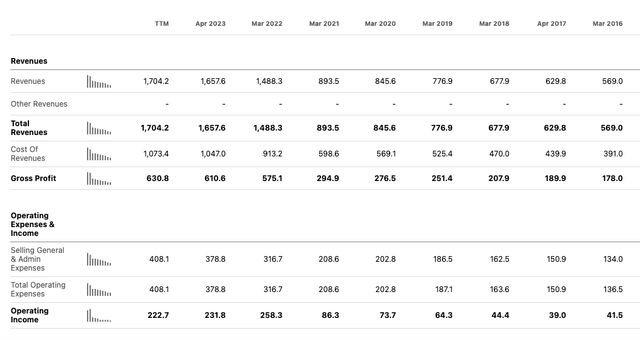

Investors should be aware that net revenue is impacted by new store sales volatility. The company did improve its gross profit margin to 38.1% in Q3 2024 from 36.5% in Q3 2023, and gross profit is upward trending if we look at TTM at $630.8 million. A recurring message, though, is that FY2024 will be less impressive than the results from the prior year. We can see this in a lowered FY 2024 guidance and within TTM results, such as operating income TTM of $222.7 million versus $231.8 million in FY 2023.

Annual revenue, gross profit and operating income (Seeking Alpha)

The company has increased its net income YoY in Q3 2024, although we can see that a TTM of $164 million is lower than FY 2023.

Annual net income (Seeking Alpha)

It does, however, continue to beat EPS expectations quarter after quarter. This can increase confidence as the company gives investors a realistic indication of what the performance is doing.

Quarterly EPS results (Seeking Alpha)

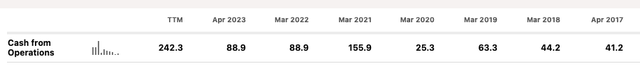

A very attractive part of the company's business is its increasing cash from operations and improved positive levered free cash flow, which is at $38.8 million TTM. Over the last few years, we have seen the company report high capex and much of this has been sourced through its cash from operations and its credit facility.

Annual cash from operations (Seeking Alpha) Annual levered free cash flow (Seeking Alpha)

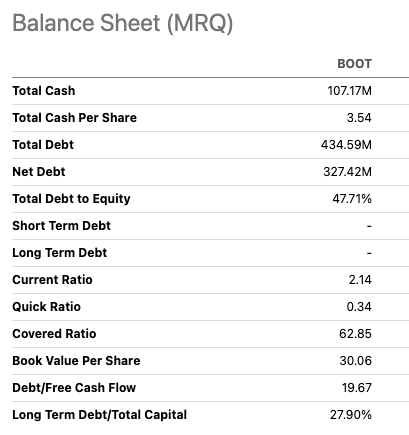

If we look at the balance sheet, we can see that the total cash increased to $107.17 million in the last report from $18.2 million in FY2023. Furthermore, the company can cover its short-term liabilities if we look at its current ratio of 2.14.

Balance sheet overview (Seeking Alpha) Annual Cash & Short Term Investments (Seeking Alpha)

Valuation

Boots Barn has seen its stock jump by 12.39% over the last three months. However, this appears to be an exaggerated response if we consider that Q3 earnings report indicated mixed results, and the company has furthermore reduced its FY2024 guideline. We can see that a number of analysts have lowered their price targets, short interest has increased, and large insider sales have been made in the previous months.

Insider sale activity 2024 (Secform4.com)

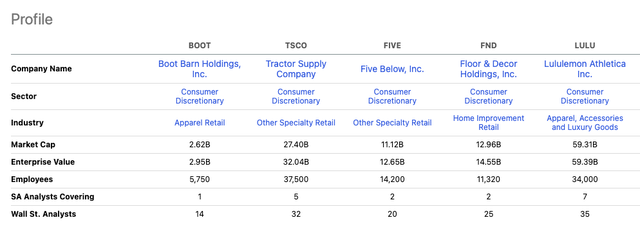

While this may not be a cause for concern, these elements combined could increase the risk of short-term price fluctuations. If we compare Boot Barn to its retail peers used within its Q3 2024 performance comparison, Boot Barn is still a smaller player if we look at its market cap and enterprise value.

Boot Barn versus other retailers (Seeking Alpha)

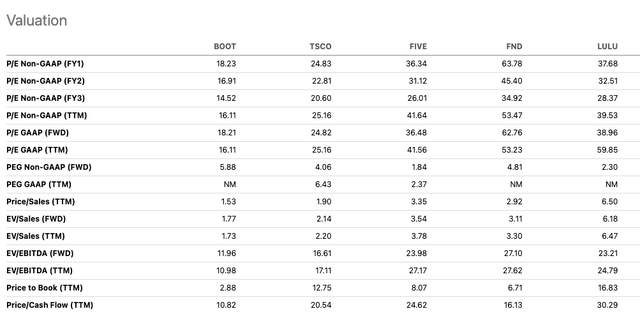

If we look at the company's FWD price-to-earnings GAAP ratio of 18.21, it appears to be undervalued relative to all of its peers in the comparison. Considering the company's long-term and aggressive growth strategy, I believe this may be the case. However, I would suggest that potential long-term investors wait until the stock price has normalised before taking any action.

Relative peer valuation (Seeking Alpha)

Risks

The company follows an aggressive growth strategy with high capex investments into new stores, technology infrastructure, and distribution. Until now, the stores have proven successful, and there is a six-year plan to continue investing in this strategy. At the same time, we are aware of how quickly the retail industry is changing due to technological advancements and fierce competition. This strategy could prove costly if customers' shopping habits were to change. Although the company has an omnichannel business model, it struggles with e-commerce sales, which have seen a double-digit decline. This can negatively impact the overall business in the long run, precisely what we have seen as the company has had to reduce its FY 2024 guidelines due to this weaker-than-expected performance. We have also seen recent insider selling activity; although this does not need to be a reason for concern, this, in combination with higher short interest, signals an increased risk in investing in the stock at this time.

Final thoughts

Boot Barn has made some significant investments over the last three years and has an ambitious growth strategy for the next six years. Many companies are much more vague regarding where the growth will come from. This is something I really like about the stock. However, we can see that weaker online sales and a decline in same-store sales have impacted the overall revenue results. I believe this is a short-term headwind, and the company is sitting on a new and flexible money-making store strategy that is working very well and will continue to do so in the coming years. The company benefits from loyal core customers and promotes its brand to a newer market. Furthermore, it appears to be undervalued relative to retail peers in the industry. However, I recommend maintaining a wait-and-see hold rating due to short interest and an exaggerated stock price reaction to relatively mediocre Q3 results.