8% Yielding REITs I Am Buying

Summary

- REIT dividend yields are historically high and safe in most cases.

- Some REITs yield as much as 8% and grow their dividend.

- I highlight two of my favorite 8% yielding REITs.

8vFanI/iStock via Getty Images

REIT (VNQ) dividend yields are today historically high.

This is because, over the past two years, their share prices have crashed even as most of them kept hiking their dividends.

As a result, there are many REITs today that offer up to 8% dividend yields and then they keep growing it every year.

In today's article, I want to give you two examples of that.

These REITs just recently hiked their dividend, guided for more growth in the coming years, and yet, they are now trading at an >8% dividend yield.

Armada Hoffler (AHH): 8% Dividend Yield And Recent 5% Dividend Hike

It is a diversified REIT that owns a mix of retail, residential, and office buildings. Generally, we dislike such "diversified REITs" because you cannot expect to earn above-average returns if you are a jack of all trades. The REIT market also doesn't like such REITs and it explains why most of them trade at large discounts relative to more specialized REITs.

But we think that AHH is an exception that's unfairly beaten down for three main reasons:

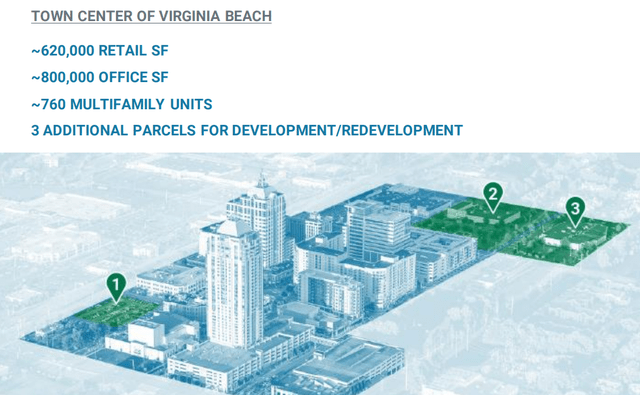

1) Geographically concentrated:

It has been geographically concentrated for 40+ years in a few specific markets in the mid-Atlantic and Southeast. Therefore, what it lacks in sector concentration, it makes up by being an absolute expert in its local markets. Most REITs take the opposite route and specialize in one property sector and they then end up investing all over the country. AHH simply does the opposite.

2) Private equity approach

It is more similar to an opportunistic private equity real estate investment firm than a regular REIT. What I mean by this is that AHH is very active in its investment approach. It develops the majority of its properties, flips some of them for a profit, and retains others for its own portfolio. It is so active with development projects that it has its own construction business and offers services to other real estate developers. This earns them substantial profits each year in the form of fees, and it also gives them a competitive advantage in their local market because they can build at a lower cost and know exactly who is building what and where.

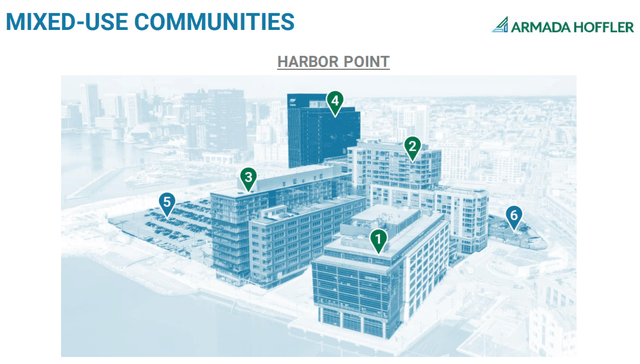

3) Mixed-use assets

Finally, while we classify AHH as a "diversified REIT", we should really create a new category for it and classify it as a "mixed-use" REIT because a lot of its development projects include many uses and that's its specialty these days. It will buy a big piece of land and then build all sorts of different uses on it within a walkable distance from one another. Such mixed-use locations are highly desirable, enjoy barriers to entry, and command large rent premiums these days.

Armada Hoffler Armada Hoffler Armada Hoffler

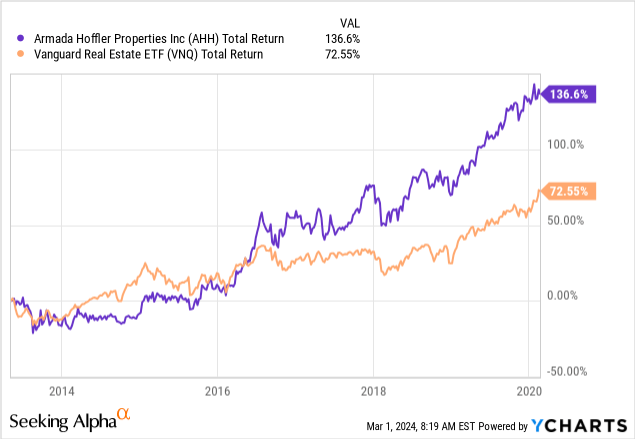

This explains why AHH is one of just a few "diversified REITs" to have historically managed to outperform the average of the REIT sector. It follows a unique approach that generates alpha-rich returns:

YCHARTS

But you will note that the above chart ends with the pandemic.

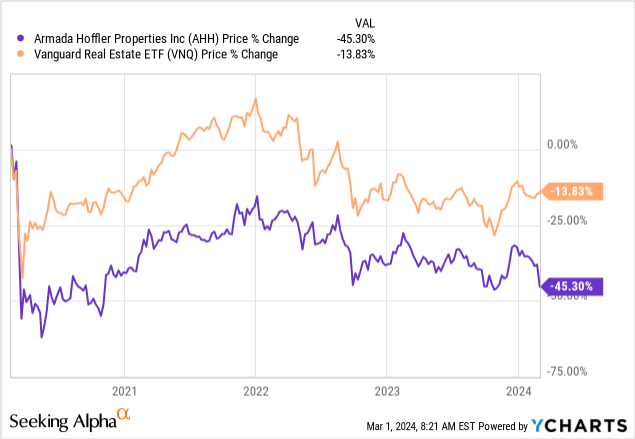

Since then, it has massively underperformed the average of the REIT sector because its market sentiment has suffered more than that of other REITs. This is somewhat understandable given that this is a small-cap and it generates about 30% of its revenue from office buildings:

YCHARTS

As a result, it is now priced at a historically low valuation of just 8x FFO, an estimated 40% discount to its NAV, and a high 8% dividend yield.

But despite this low valuation, its FFO per share just reached new all-time highs. The company just released its 2023 full-year results and its FFO per share reached $1.24 which is higher than before the pandemic. On the same occasion, the REIT also hiked its dividend by another 5% and the management made the following statement on their conference call: [emphasis added]

"We’ve raised the dividend a solid 5% to $0.205 per quarter. This increase brings the dividend into alignment with our long standing coverage parameters of approximately 80% of AFFO. More importantly, it is indicative of management’s confidence in the trajectory of our business model, increased property NOI, strong leasing activity and development income expected to come online in the fourth quarter, all factor into our confidence in our core business and sustainability of our current cash flows."

That's not exactly what you typically hear from a REIT that's priced at such a low valuation.

So what is the market missing?

I think that it is three things:

1) High Exposure to Strip Centers and Multifamily

First, about 70% of the REIT's cash flow comes from service-oriented retail and apartment communities. Both of these properties are today very popular and are priced at relatively high valuations in the private market.

We all know that cap rates are very low for multifamily, but high-quality retail is also in high demand because it is performing particularly well today. Unlike other property sectors, there have been relatively few new retail development projects over the past decade because it has been out of favor. As a result, it enjoys strong demand/supply dynamics and even retail REITs now trade at relatively high valuations when compared to many other property sectors. AHH generates about 45% of its rents from service-oriented retail and another 23% from apartment communities, but it is getting much credit for it.

2) Focus on Class A Trophy Assets

AHH owns class A properties that are typically in mixed-use locations. Remember that AHH has been a real estate developer for decades. It sells some assets and it retains some others for its own portfolio. Which assets do you think it decides to keep for the long run? They are the very best assets in its markets. This is well-evidenced by the REIT's average occupancy of 96.1%. The market worries about its office buildings, but even those enjoy a 95.3% occupancy rate. AHH owns class A office space in mixed-use destinations and that type of office space may even benefit from the switch to hybrid work as more and more employers decide to lease less, but higher-quality office space going forward.

Here is what the management said about their office buildings on their most recent conference call: [emphasis added]

Our office portfolio is comprised of trophy assets, which are highly leased at 95.3% and therefore differentiation should be recognized when applying an earnings multiple.

As you know, our office products are best positioned in their respective submarkets and are integral to robust and active mixed use ecosystems. These factors have resulted in our Armada Hoffler’s portfolio benefiting from the continued flight to quality evidenced by elevated occupancy and leasing activity, as well as establishing their own superior market rents that defy trends in the office space overall. They expect to maintain relative outperformance of the competitive set to not only continue, but accelerate over time as employers prefer highly amenitized Class A assets in mixed use environments.

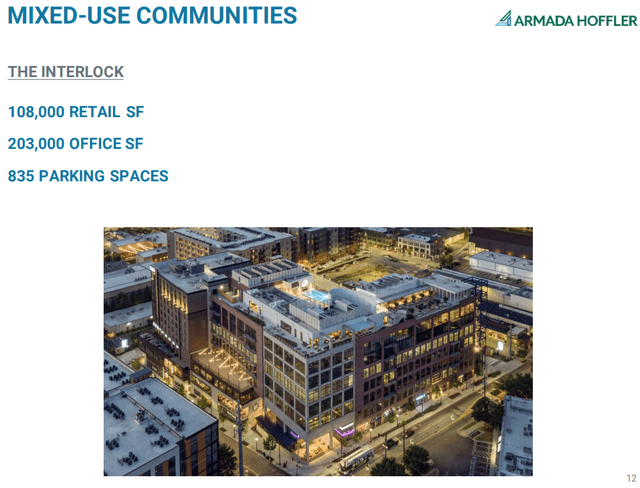

The 95%+ occupancy rate of their office buildings is good proof of that, and how they are dealing with the WeWork bankruptcy is also additional evidence that there is plenty of demand for their office buildings. Instead of granting them a rent cut to keep them as a tenant, they decided to kick them out because they were confident that they could refill this space with other tenants who would pay a higher rent. Here is what they said: [emphasis added]

"An opportunity for leasing was recently created from our intentional removal of WeWork from the Interlock asset in Atlanta. We are not willing to impair our trophy asset with a long-term punitive lease and therefore, we’re not willing to accept the terms WeWork needed to stay in the building. As a result, we canceled the lease and simultaneously reduced our forward exposure to the tenant...

While this created a temporary blip in Same Store office NOI, given the quality and location of the Interlock, we are confident that this space will be quickly released with creditworthy long-term tenants. We have seen significant activity since the announcement and look forward to updating you on our progress."

The market does not like this because it leads to a temporary loss in rents and vacancies always come with some uncertainty. It is one of the reasons why its FFO per share will stagnate in 2024.

But I view it differently. I see it as a sign of strength that they did not cave into WeWork's demands and were willing to kick them out, despite the risk that this presents. It shows you how confident they are in the quality of their assets.

3) Strong Shareholder Alignment

It seems that one other reason why AHH dipped following its Q4 results was the management's indication that they would make use of their ATM to issue some shares in 2024. Given that their stock price is today heavily discounted, this would likely dilute shareholders on a per share. This sort of behavior is typically a sign of conflicts of interest and it is scaring investors.

But I don't think that this is something to worry about.

Last year, I met the management at a conference where they reminded investors that they are among the largest shareholders of the company, owning 14% of the equity, and they are motivated to see the share price reflect their fair value. Last year, they actually bought back some shares and since then, their share price has dropped lower so it is hard for me to imagine that they would issue any significant amount of capital. At the same conference, the management also said that they don't need to sell much if any equity since they are in a good position to self-fund their growth.

Moreover, one of the first slides in their investor presentation says they are seeking "accretive" investments compared to "conservative cost of capital" assumptions, and their guidance for 2024 said that they would seek to "opportunistically" sell common equity through the ATM program.

I think that what they mean here is that they will sell some shares if and when their share price recovers to a more reasonable cost of capital, but I would not expect any significant sales at these levels. That simply wouldn't make sense.

So all in all, I think that the market underappreciating AHH because it perceives it as a diversified REIT with no growth. In reality, AHH is a mixed-use REIT that's able to create a lot of value by developing properties and it has enjoyed strong growth over the long run.

As it keeps proving the market wrong, its valuation will again eventually recover to a more reasonable level. Simply recovering to 12x FFO would unlock 50% upside from here and you earn a high 8% dividend yield while you wait.

It is rare to get to buy a REIT that owns trophy assets and just hiked its dividend by 5% at such a low multiple and an >8% dividend yield. Therefore, we plan to accumulate more shares over the coming months if it continues to trade at these levels.

EPR Properties (EPR): 8.3% Dividend Yield And Recent 3.6% Dividend Hike

EPR Properties is a net lease REIT that specializes in experiential properties such as movie theaters, golf complexes, ski resorts, and hot springs.

EPR Properties

We just recently posted a review of the company so I will keep this one a bit shorter and go straight into its latest results. In case you are not familiar with the company, you can read our article on it by clicking here.

The main highlights were the following:

- It grew its FFO per share by ~6% in 2023, reaching its pre-pandemic levels.

- It guided for another ~3-4% of FFO per share growth in 2024.

- It hiked its dividend by another 3.6%, despite already yielding 8.3%.

- They guided to acquire another ~$250 million worth of assets at high cap rates in 2024, and that growth comes on top of its ~2% rent escalations.

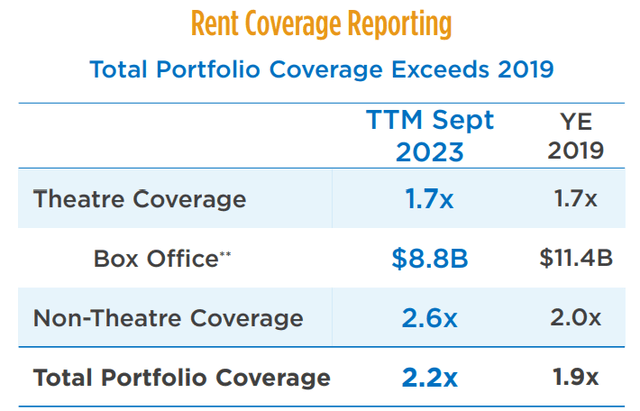

- The rent coverage of its non-theater assets reached 2.6x, up from 2.2x before the pandemic.

- The rent coverage of its theaters recovered to 1.7x, which is in-line with pre-pandemic levels, despite a box office that's still 20% lower.

This is very encouraging because it shows that the fears over its movie theaters are overblown.

Its theater properties have now fully recovered from the pandemic and things will only get better in the coming years as the box office continues its recovery.

Moreover, since these properties are under 10+ year long triple net leases with annual rent escalations and their rent coverage is already nearing 2x, it appears unlikely that they would face any major issues. This is particularly true because their two biggest leases (AMC & Regal) have now already been renegotiated in a way that should mitigate risks going forward.

EPR Properties

The other 75% of the portfolio (as measured by NAV) is today doing better than ever and continues to benefit from the booming experience economy. This long-term trend is not going anywhere as more and more people prefer to spend money on experiences rather than things.

EPR Properties

Yet, EPR is today still priced at just 8.5x FFO, an estimated 30% discount to its NAV, and offers an 8.3% dividend yield. That's an unusually low valuation for an investment-grade-rated REIT that enjoys strong long-term growth prospects.

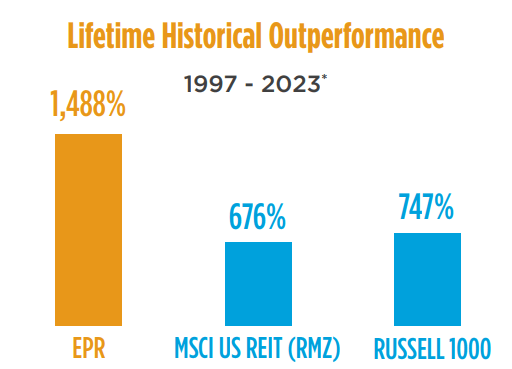

I would also remind you that EPR has historically been one of the most rewarding REITs. People have been calling for the death of theaters for decades, but EPR's management has an amazing track record of proving people wrong:

EPR Properties

Even if it recovered to just 12x FFO, that would unlock nearly 50% upside from here and while you wait you earn an 8.3% dividend yield and the REIT keeps on growing.

That's exactly the type of opportunities that we like to target.